In this exciting new episode of the Hustle Finesse Series, we’re diving into the dynamic and often intimidating world of stock and forex trading. But here’s the twist – we’re not just playing the game; we’re changing it with the power of AI and Fibonacci!

Trading Forex: Taking the Plunge with Real Cash

I’ve taken a bold step and opened a live trading account, depositing a modest sum to test the waters.

This isn’t about making a fortune overnight; it’s about understanding the mechanics of successful trading. It’s crucial to start with the basics – you can’t build a house without laying the foundation first, right?

The Journey Begins: Back to Basics of Trading Forex

Before we can finesse our way through the complexities of trading, we need to grasp the essentials. I’m starting with the basics of forex and stock trading, but the end goal is clear – to streamline and perfect my trading strategy using AI, automation, and the Fibonacci sequence.

Understanding Forex Market Dynamics

The Forex market is fascinating due to its continuous operation; it’s open 24 hours a day, five days a week, across various time zones. This means opportunities are always present, but so are risks. The market is influenced by a myriad of factors, including economic indicators, political events, and market sentiment.

Currency Pairs: The Building Blocks

At the heart of Forex trading are currency pairs.

These pairs represent the exchange rate between two currencies. For example, EUR/USD is a pair comparing the value of the Euro to the US Dollar. Understanding how pairs work is crucial. There are major pairs, like EUR/USD, and exotic pairs, which include currencies from smaller or emerging economies.

The Role of Leverage

Leverage is a double-edged sword in Forex trading. It allows traders to control large positions with a relatively small amount of capital. However, while it can amplify profits, it can also magnify losses. Responsible use of leverage is a fundamental skill every Forex trader must learn.

Analyzing the Market

There are two primary approaches to analyzing the Forex market: fundamental and technical analysis. Fundamental analysis involves studying economic indicators, central bank policies, and political events to predict currency movements. Technical analysis, on the other hand, relies on historical price data and chart patterns to forecast future movements.

Risk Management: The Key to Longevity

One of the most important aspects of Forex trading is risk management.

This involves setting stop-loss orders to limit potential losses, managing the size of your positions, and never investing more than you can afford to lose. Effective risk management is essential for sustainable trading.

The Importance of a Trading Plan

A well-thought-out trading plan is your roadmap in the Forex market. It should include your investment goals, risk tolerance, trading strategy, and criteria for entering and exiting trades. A disciplined approach to following your plan is crucial for success.

Continuous Learning and Adaptation

The Forex market is dynamic and ever-changing. Continuous learning and adaptation are vital. This includes staying updated with market news, analyzing your trades, and learning from both successes and failures.

Embracing Technology

In today’s trading landscape, technology plays a pivotal role.

From advanced charting tools to economic calendars, technology aids in making informed decisions. As we progress in our journey, the integration of AI and automation will take center stage, enhancing our trading strategies and decision-making processes.

Fibonacci: The Golden Key in Trading

For those unfamiliar, Fibonacci is not just a historical figure but a mathematical sequence used extensively in trading. It’s about ratios and patterns that occur naturally in the world, and surprisingly, in the financial markets too. Understanding Fibonacci is like having a secret map to navigate the market’s ebbs and flows.

In the realm of trading, Fibonacci retracement levels are revered as the ‘Golden Key’ for their unique ability to predict potential support and resistance levels in the markets. Originating from the Fibonacci sequence, a series of numbers where each number is the sum of the two preceding ones (0, 1, 1, 2, 3, 5, 8, 13, 21, …), these levels have found a significant place in technical analysis.

The Fibonacci Sequence: A Natural Phenomenon

The Fibonacci sequence is not just a mathematical concept; it’s a natural phenomenon observed in various forms, from the arrangement of leaves on a stem to the spirals of a seashell. In trading, this natural order is translated into ratios that are used to predict price movements.

Fibonacci Ratios and Trading

The key Fibonacci ratios used in trading are 23.6%, 38.2%, 50%, 61.8%, and 100%.

These ratios are derived by dividing certain numbers in the Fibonacci sequence. For example, the 61.8% ratio, often referred to as the ‘Golden Ratio,’ is found by dividing a number in the sequence by the number that follows it.

Applying Fibonacci to the Markets

In practice, Fibonacci retracement levels are drawn by identifying the high and low points of a significant price movement on a chart. The levels between these two points indicate where support and resistance are likely to occur. Traders use these levels to make educated guesses about where the price might reverse or continue its trend.

Why Fibonacci Works

The effectiveness of Fibonacci retracement levels lies in their ability to reflect the psychology of the market. These levels become self-fulfilling as many traders watch and make decisions based on them. When a large number of traders react to these levels, they can influence the market movement, making these levels significant points of interest.

Fibonacci in Conjunction with Other Tools

While Fibonacci levels are powerful, they are most effective when used in conjunction with other technical analysis tools. This includes trend lines, moving averages, and other indicators. The confluence of Fibonacci levels with other signals provides a stronger case for potential market turns.

The Limitations of Fibonacci

It’s important to remember that Fibonacci retracement levels are not foolproof. They are a tool to provide insights, not guarantees. Markets can behave unpredictably, and external factors like economic news can override technical patterns.

Incorporating Fibonacci in My Trading Strategy

As we progress in our trading journey, incorporating Fibonacci retracement levels will be a key strategy. It will aid in identifying potential entry and exit points, enhancing our decision-making process. However, it’s crucial to use these tools as part of a broader strategy, combining them with sound risk management and market analysis.

Emotion-Free Trading with AI and Automation

The beauty of incorporating AI and automation into trading is the removal of emotional decision-making. It’s about precision, efficiency, and letting technology do the heavy lifting. This approach allows me to focus on what I love, using trading as a means to bolster my income.

Episode One: Setting the Stage

In this first episode, it’s all about planning and setup.

I’ve chosen Oanda as my trading platform and created two types of accounts – a regular forex account and an MT4 forex account, each funded with $20. The reason for two accounts? Experimentation and learning.

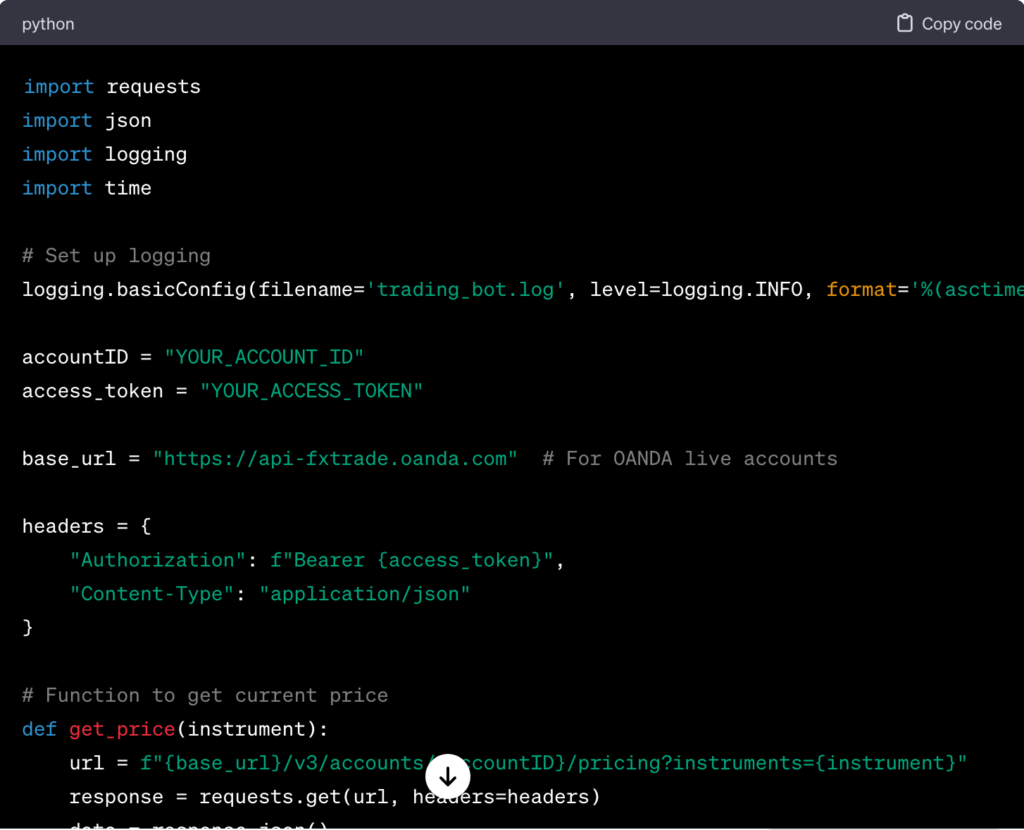

The Birth of a Trading Bot

So i’ve been coding for years. Back when i started i self-taught myself and spent hours, days, weeks, months trying and failing and learning how to build. Nowadays you can actuall use AI to code. I’ve ventured into the realm of coding with AI and created a Python trading bot that runs on my MacBook, as you can see some of that code above. This bot is linked up to my Oanda MT4 forex account for automated trading via an API. After much trial and error, the bot is operational but still in its infancy. It uses historical data to inform its trading decisions, but there’s a long road ahead to refine its capabilities.

If you want to do this yourself, basically, you have to put your Oanda Account ID and API where it says accountID and access_token and you’ll be connected to your trading account.

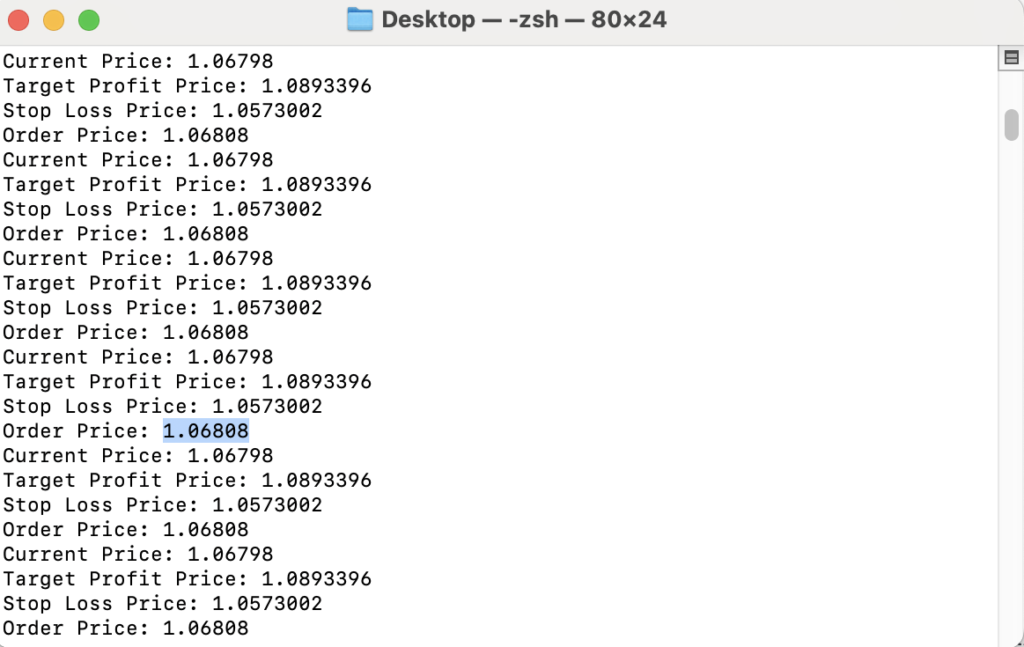

Here is what happens when i run this trading bot on my terminal on my MacBook:

So basically the bot is able to run indefinitely with no errors. Now it’s not making bands on bands for me while i sleep yet but just getting it to run with no errors is actually a big feat. Next steps are to get it to place successful trades and the sky is the limit from there.

The Road Ahead: Learning and Tweaking

The next steps involve a dual approach. On one hand, I’ll continue to develop and tweak the trading bot, enhancing its ability to make informed trades. On the other, I’ll immerse myself in the basics of forex trading, actively engaging with my other live account to gain hands-on experience.

Join Me on This Trading Adventure

So, there you have it – the beginning of a journey where technology meets traditional trading. It’s a path filled with learning, experimentation, and the promise of transforming how we approach the financial markets. Stay tuned for more updates as I navigate the highs and lows of this exciting venture. Let’s hustle with finesse in the world of stocks and forex!

Curious about how this journey unfolds? Keep following the Hustle Finesse Series for real-time updates, insights, and lessons from my foray into AI-powered stock and forex trading. Let’s demystify the financial markets together!

I’m Brynt, I’m here to guide you through the world of online hustles and help you find your financial flow. Join me on this exciting path towards financial freedom. Stay tuned for my “Hustle Finesse” series, where I personally dive into various side hustles, testing, reviewing and documenting my process throughout the entire journey.

Check out the HF series kickoff with 100 Online Hustles for Financial Freedom